- The U.S. is scrambling to secure critical minerals as supply chains tighten under global pressure

- Resolution Minerals has begun drilling at its Horse Heaven Project, directly adjacent to Perpetua Resources' world-class Stibnite deposit

- LMLF's neighbor Perpetua Resources has the only antimony resource in the USA, and the US Department of Defense has provided millions in funding to bring its antimony-gold project online

- Antimony is a critical mineral used in various defense applications including as a hardening agent for ammunition. In December last year China banned the export of antimony to the US

- Resolution Minerals' horse heaven project previously produced antimony and tungsten during WWI and WWII. RLMLF will be drilling for antimony this month

For decades, the United States has depended heavily on foreign suppliers for %CriticalMinerals like %Antimony, %Tungsten, and rare earth elements, materials essential to defense technologies, renewable energy, and high-tech manufacturing. That dependence has grown more precarious in recent years. China and Russia now dominate global supply, and Beijing's December 2024 ban on antimony exports to the U.S. amplified the urgency of reshoring these strategic resources.

Against this backdrop, a new player is emerging on U.S. markets: %ResolutionMinerals Ltd. (OTC: $RLMLF) (ASX: RML).

The Benchmark: Perpetua Resources

Idaho is already home to one of America's most advanced critical mineral projects: %PerpetuaResources Corp. (NASDAQ: $PPTA) (TSX: PPTA). Its Stibnite Gold Project hosts a 4.8 million ounce gold reserve alongside 200 million pounds of military-grade antimony, a combination that has secured $74 million in Department of Defense funding. With a market cap around A$3 billion, Perpetua demonstrates the value investors, and the U.S. government is willing to place on secure U.S. antimony production.

Rare Earth Anchors: MP Materials and United States Antimony Corp.

%MPMaterials (NYSE: $MP) operates the Mountain Pass Mine in California, North America's only scaled rare earth mining and processing facility. Its ability to produce the raw materials needed for %EV motors, wind turbines, and defense technology makes it central to the U.S. supply chain strategy.

The US Department of Defense has shown a willingness to back strategic projects like MP Materials' Mountain Pass Mine, by providing a US$400M investment stake, a US$100M loan facility and most importantly, a price floor for rare earths purchases more than double the current market value out of China.

This support from the US government for the sector is unprecedented and shows the potential for high quality mining projects that can support the America first agenda.

Meanwhile, %UnitedStatesAntimony Corp. (NYSE: $UAMY) sells antimony, zeolite, and precious metals primarily in the U.S. and Canada. The Company processes third party ore primarily into antimony oxide, antimony metal, antimony trisulfide, and precious metals at its facilities located in Montana and Mexico.

Resolution Minerals: Positioned at the Center of U.S. Strategy

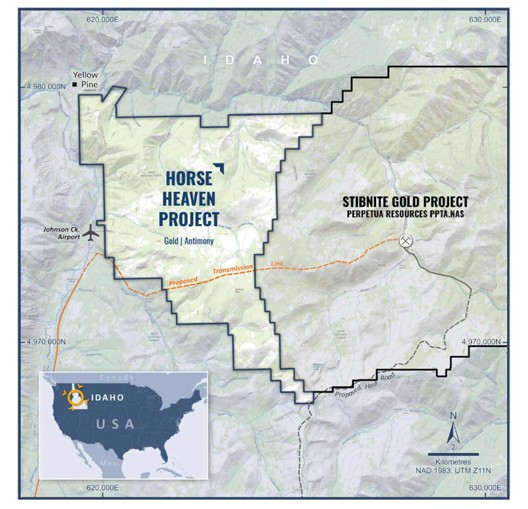

Resolution Minerals enters this landscape with its Horse Heaven Antimony-Gold-Tungsten Project in Valley County, Idaho. The project covers 5,644 hectares and directly borders Perpetua's Stibnite property. This proximity is more than geographical, the geology, mineralization, and strategic significance are tightly linked. That's particularly important against the backdrop of Stibnite having a reserve of 200 million pounds of Antimony, one of the largest economic reserves of Antimony globally that's not controlled by China.

Horse Heaven has already proven its value in history. During World War I, World War II, and the Korean War, it supplied the U.S. Government with antimony and tungsten, both critical for munitions and military technology. Today, with the U.S. producing zero domestic antimony, the project's revival couldn't come at a more important moment.

Drilling Underway: A Clear Path to Resource Definition

Resolution kicked off its Phase 1 drill program in August 2025, targeting up to 6,000 meters across 20 holes, starting with 3,000 meters at Golden Gate. The goal is twofold: confirm historic %Gold mineralization and systematically assay for antimony and tungsten for the first time.

Historical drilling already delivered standout results, including:

- 85.3m @ 0.94 g/t Au (incl. 38.1m @ 1.46 g/t Au)

- 105.2m @ 0.79 g/t Au (incl. 51.8m @ 0.99 g/t Au)

- 30.5m @ 1.35 g/t Au

Surface assays have revealed even higher grades, with samples returning up to 19.15% antimony, 5.9 g/t gold, 367 g/t silver, and 230 g/t tungsten. With permits secured for 59 drill holes across 19 sites, the company is laying the groundwork for a 10,000-meter program in 2026, which could underpin a maiden resource estimate by 2026/27.

Aligning with U.S. Policy and Federal Incentives

Resolution isn't advancing Horse Heaven in isolation. The company has retained Thorn Run Partners, a top-tier Washington, D.C. lobbying and government relations firm, to help position the project for U.S. federal support. Idaho's newly passed SPEED (the Strategic Permitting, Efficiency, and Economic Development) Act (2025) further accelerates permitting for critical mineral projects, placing Horse Heaven on a fast track for exploration and development approvals.

Congress is also weighing a US$2.5 billion allocation for domestic critical mineral development, opening the door to funding partnerships similar to those already secured by Perpetua and Lynas.

Market Interest and M&A Potential

Nothing may speak to the brilliance of Resolution acquiring Horse Heaven as clearly as a peer already coming calling. The project has already attracted unsolicited outside attention. In August 2025, Snow Lake Resources (NASDAQ: LITM) tabled a $225 million non-binding offer for Horse Heaven. Resolution entered a short-term exclusivity period to allow Snow Lake to conduct due diligence, while also making clear it would seek to maximize shareholder value in any potential deal. Notably, Resolution has signaled a preference for a whole-of-company transaction rather than a simple asset sale, underscoring management's confidence in the broader portfolio.

Leadership with Global Expertise

Execution matters in mining, and Resolution is guided by a leadership team with deep international experience. Craig Lindsay serves as CEO of U.S. Operations, bringing decades of North American capital markets and mining finance experience to the table. Lindsay has previously led successful listings and project financings across multiple jurisdictions, providing the right connections as Resolution enters U.S. markets.

Resolution's lead consulting geologist Austin Zinsser worked for Perpetua Resources in exploration and development roles for 12 years.

The board is also reinforced with directors and advisors who combine technical expertise in gold, antimony, and uranium exploration with a strong background in corporate governance. This includes the additions of experts like renowned Washington-based external affairs advisor Todd Clewett, Steve Promnitz (helped take Lake Resources from $1 million market cap to $3 billion), and Brett Lynch (helped take Sayona Mining to a market cap in the billions).

Why Resolution Now?

With its new U.S. listing under ticker RLMLF, Resolution Minerals is entering American markets at the precise moment the U.S. is scrambling to rebuild its domestic supply chain for critical minerals. Its Horse Heaven Project is not only geologically analogous to Perpetua's Stibnite but also shares the same historical role as a past supplier to the U.S. military. Early drilling is underway, permits are in hand, and federal policy winds are shifting in favor of exactly this type of project.

While giants like Perpetua, MP Materials and United States Antimony represent established anchors of the sector, Resolution offers investors an early-stage opportunity with high leverage to discovery and strategic value creation. In an era defined by critical mineral competition, Resolution Minerals could soon evolve from neighbor to necessary partner in America's resource independence strategy.

Talking just numbers, consider that Perpetua was trading around $1.70 late in 2023 before the grants and all the excitement started around its Stibnite project. It has climbed more than 1,000% to over $18.00 per share.

Investor Takeaways

- Timing: U.S. listing (OTCQB: RLMLF) coincides with federal focus on reshoring critical minerals.

- Assets: Horse Heaven Project in Idaho offers gold, tungsten, silver, and antimony, a direct parallel to Perpetua's world-class Stibnite deposit.

- Positioning: Experienced leadership, strong U.S. political engagement, and unsolicited M&A interest underscore Resolution's strategic potential.

More information on RLMLF can be found here: https://nextinvestors.com/articles/rml-now-drilling-next-door-to-29bn-capped-usa-antimony-leader/

Disclaimer:

All opinions and information provided above are intended for educational and research purposes only. The information provided above should be used as a starting point for conducting any research on the public companies discussed. All readers should do their own due diligence and research when determining which investment strategies are best suited for them or seek the advice of an investment professional prior to making an investment decision. The profiles of the above discussed public companies are not in any way a solicitation or a recommendation to buy, sell or hold their securities. A third-party to Resolution Minerals Ltd. has initiated AllPennyStocks.com for digital media advertising valued at four thousand dollars.

Any forward-looking statements set forth in the article above are based on expectations, estimates and projections at the time such statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements may be identified through the use of words such as "projects," "foresees" "expects," "will," "anticipates," "estimates," "believes," "understands" or by statements indicating certain actions "may," "could" or "might" occur. There is no guarantee past performance will be indicative of future results or that any such forward-looking projections will occur.

For a complete disclaimer, investors are encouraged to click here: https://www.allpennystocks.com/disclaimer/

COMTEX_468297609/2848/2025-08-25T07:31:01